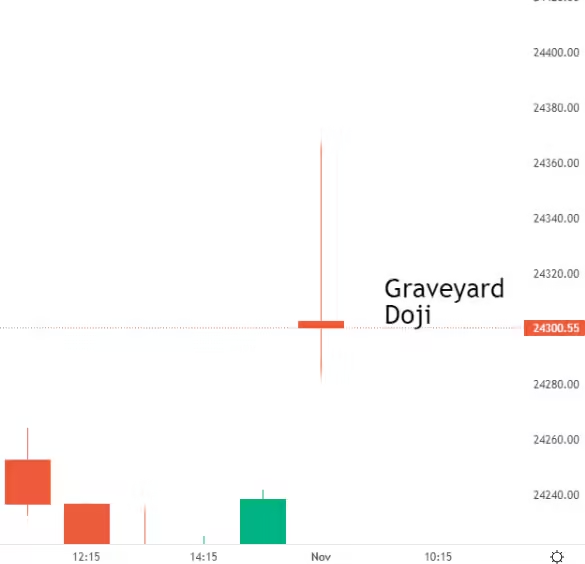

Graveyard Doji is a candlestick pattern which is indicating further downfall in India’s Benchmark Index, Nifty 50.

The recent appearance of a Graveyard Doji pattern in the Nifty 50 index raises questions about the potential for further downside in the Indian market. This follows a double-top formation that previously led to a notable decline. With Nifty currently hovering around the critical 24,500 mark, the focus shifts to whether these levels will hold amidst cautious investor sentiment.

Read more: Will Nifty Hold Gains Above 24,500?

Understanding “The Graveyard Doji“

The Graveyard Doji is a single-candlestick pattern often seen in technical analysis. It represents indecision in the market, occurring when an instrument opens, rises sharply, and then closes near its opening price, leaving a long upper shadow and a small or nonexistent body. This pattern suggests a potential reversal or bearish trend, as buyers initially dominated but sellers ultimately drove the price back down.

Recent Movements in the Indian Stock Market

Recently we saw a Double Top Pattern being formed in the Indian Stock Market indices. Which led to a fall of over 2% in a week in major indices like Nifty 50 and Sensex, each. A couple of days later we observed that Nifty 50 formed the same pattern again, resisting the level of 24,500.

Read More: The Double Top Pattern: A Continuing Impact on India’s Stock Market

Why Did The Market Rise on Muhurat Trading?

Positive Sentiments

Muhurat Trading is a symbolic, auspicious trading session conducted by stock exchanges in India during Diwali, marking the start of a new financial year according to the Hindu calendar. It’s a long-standing tradition that traders believe brings prosperity and luck for the year ahead. Typically, this session sees high enthusiasm, with traders, especially retail investors, placing trades as a ritualistic gesture. Many see it as a good opportunity to make small, symbolic investments and initiate new portfolios with the hope of profitable returns, thus, converting the sentiments from negative to positive.

Oversold Stocks

Majority of high quality stocks that have been performing good fundamentally, are now available at a very cheap rate. Oversold stocks are those that have declined sharply in price, often due to excessive selling. This condition can make them undervalued and potentially poised for a rebound. This is also a reason for sharp buying in cash and future stocks as well as indices.

Global Market Sentiments

Asian Markets closed positively with Japan’s Nikkei 225 index closing with weekly gains of 0.78% at JPY 38,052 and Hong Kong’s Hang Seng index closing with weekly gains of 0.93% to close at HK$ 20,506.43.

European Markets held along with holding gains throughout the day with UK’s FTSE 100 trading with gains of 1.08% at £8,198.02, France’s CAC 40 trading with gains of 0.43% at €7,411.59 and Germany’s DAX with gains of 0.74% at €19,217.91.

Way Ahead

While Graveyard Doji suggests a bearish trend, however it’s wise to focus on safe investment strategies and exercise caution. Avoid new high-risk trades in this market environment, and use stop-losses to minimize potential losses. Booking profits on existing profitable trades is a smart approach to maintain a positive outlook, safeguarding gains as the market evolves.