Moody’s warns of risks from borrowing plan in Friday report. UK bonds to stabilize after weak US jobs report; Labour’s spending plans stir market concerns.

A significant selloff in UK bonds, which pushed borrowing costs to a one-year high, eased on Friday as a disappointing US jobs report increased demand for global debt.

Initially, UK gilts fell for a third consecutive day due to concerns over the Labour Party’s plans for increased borrowing and spending. However, the bond market stabilized following signs of weakness in American payrolls, which bolstered the argument for interest rate cuts to support global economic growth.

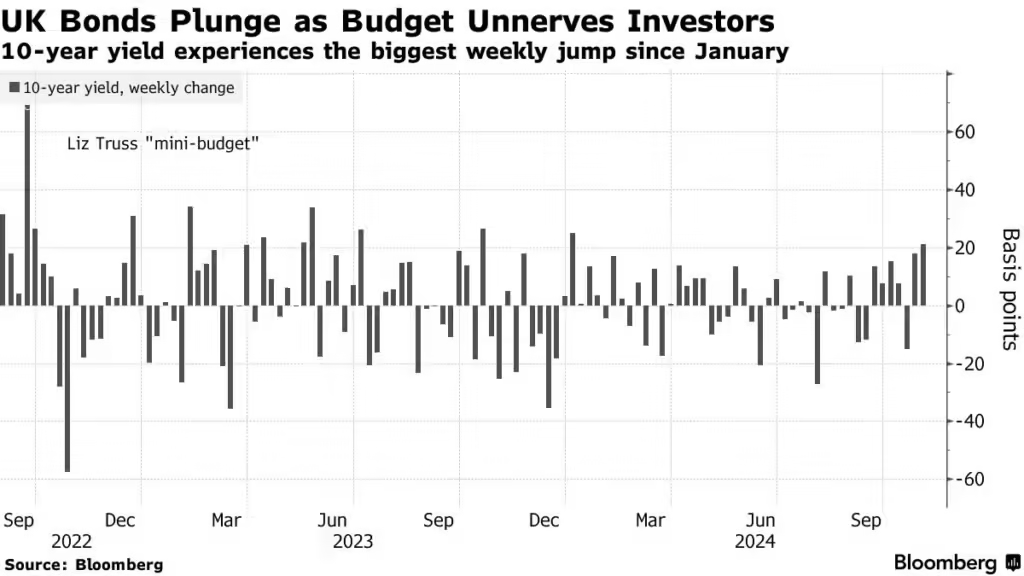

As a result, the yield on benchmark 10-year gilts reached 4.45%, marking a 21 basis point increase over the past week—the largest weekly rise since January. Both Moody’s and S&P Global have expressed a pessimistic outlook on the UK’s fiscal situation.

This reaction is likely not what Chancellor Rachel Reeves anticipated for her first budget. Although she had previewed much of Labour’s spending plans beforehand, the announcement itself did not significantly alter market expectations. However, projections from the Office for Budget Responsibility indicated higher inflation and fewer anticipated interest rate cuts due to Labour’s fiscal plans, leading to a swift selloff in bonds, stocks, and the pound.

Read More: UK Budget 2024: All You Need To Know With Daily Equity

In an effort to reassure financial markets, Reeves emphasized “economic and fiscal stability” in an interview with Bloomberg TV among various others. Yet, comparisons to the gilt market turmoil following Liz Truss’s September 2022 mini-budget were unavoidable, especially given Labour’s positioning as a remedy to previous financial instability.

Stefan Koopman, senior macro strategist at Rabobank, noted that the UK bond market appears to be suffering from “post-Truss stress disorder.” He observed that in the face of uncertainty, investors are prioritizing risk management. While the current market moves are less severe than previous episodes, they highlight the fragility of the gilt market and the limited margin for error that Labour faces in revitalizing the sluggish economy.

Moody’s Friday report warned that the proposed increase in borrowing—partly enabled by a new debt measurement—would create “additional challenges” for the already difficult task of fiscal consolidation in the UK. This sentiment was echoed by the OBR, which labeled Labour’s plan as “one of the largest fiscal loosenings in recent decades.”

Reeves’ budget includes a £70 billion ($90 billion) annual increase in public spending and an additional £100 billion for capital projects, leading to an estimated £142 billion in extra borrowing over the next five years.

Chris Iggo, chair of AXA IM Investment Institute, commented that fiscal policy now poses a greater risk to markets than monetary policy, as demonstrated this week. He noted that gilts appear to offer reasonable medium-term value at current yield levels, especially since the Bank of England is expected to continue reducing interest rates, albeit at a slower pace than previously anticipated.

Bank Of England Outlook

Traders were left in doubt over whether the Bank of England will cut interest rates three or four times by December 2025, with policymakers set to meet next week and give their latest evaluation on inflation.

While a quarter-point cut is viewed as likely on Thursday, investors will be listening for any reaction to Reeves’ budget — and the market’s response — from BOE Governor Andrew Bailey. The extra volatility from the UK comes at a sensitive time for markets as hotly contested US elections threaten price swings in Treasuries — and bond markets globally.

In Friday’s session, 10-year gilt yields climbed as much as six basis points to 4.51% before erasing that move to trade little changed at 4.45%. Two-year yields — up about 27 basis points on the week — were close to flat after surging the day before. The path of yields from here will play a crucial role in whether Reeves can deliver the budget’s growth goals while also meeting the fiscal deficit rules, given the risk that higher borrowing costs erode her modest buffer.

“If yields keep rising the government will be under pressure to say how it would seek to restore some headroom,” said Sam Hill, head of market insights at Lloyds Bank.