Foreign Institutional Investors (FIIs) play a vital role in India’s financial markets by injecting significant capital, enhancing liquidity, and influencing market sentiment. Conversely, Domestic Institutional Investors (DIIs) provide stability and long-term investment strategies, reflecting confidence in India’s economic potential.

The stock market is influenced by the actions of all participants, regardless of their size. Each buy or sell decision can affect stock prices, making it essential to identify which groups dominate the market.

Retail investors, like individuals investing in stocks, fall into one category, while institutional investors, such as mutual funds and pension funds, are classified as either Foreign Institutional Investors (FIIs) or Domestic Institutional Investors (DIIs). Together, these three segments play a vital role in shaping market dynamics. Historically, FIIs have been significant players in the Indian markets, often impacting market direction with their movements. But the question remains: do they still hold that influence today? Let’s explore further.

What Are FIIs?

Foreign Institutional Investors (FIIs) are financial institutions or investors based outside a country who invest in its financial markets, typically targeting equities, bonds, and other assets. In India, FIIs are essential players in capital markets as they inject large-scale foreign capital, which improves liquidity, market depth, and overall sentiment. These entities include mutual funds, pension funds, insurance companies, hedge funds, and sovereign wealth funds.

FIIs have a significant influence on Indian stock markets. Large inflows from FIIs often drive market rallies, boost investor confidence, and help strengthen the domestic currency by increasing demand for Indian assets. Conversely, sudden outflows can create volatility and lead to market corrections, especially during periods of global economic uncertainty or geopolitical tensions.

The Securities and Exchange Board of India (SEBI) regulates FII operations, ensuring compliance and stability. FIIs must register with SEBI before participating in Indian markets. They can invest within prescribed limits, such as a cap on ownership in government securities and corporate bonds. These restrictions are in place to avoid excessive foreign influence on critical sectors and to maintain economic sovereignty.

Global factors like U.S. Federal Reserve interest rate changes, geopolitical developments, and domestic reforms often impact FII strategies. For example, higher interest rates in developed countries might prompt FIIs to pull out funds from emerging markets like India to seek safer, more lucrative returns.

Prominent FIIs to Indian Stock Market

From 2009 to 2015, we had an excellent period of foreign investor participation. In 2010 alone, FIIs injected US$ 29.3 billion in Indian equities. The reason was Quantitative Easing (QE) adopted by the developed economies. QE in simple terms means – money printing. These central banks printed money and flooded with cheap liquidity. This flood of cheap money found its way into many emerging markets, including India.

The period from 2016 till 2018 of weak FII participation coincided with the US central bank’s goal to normalize the monetary policy. In the last three years till August 2021, FIIs seem to have returned to India. In the last 20 years, there have been only three calendar years when FIIs have pulled out money from India, despite the consistent currency depreciation and worldwide disruptions.

Overall, FII holdings over the last 20 years have increased in India. Nearly 22-23% of BSE-500 is today owned by FIIs, and they have become the second-largest investors after promoters.

Not only that, India has been an outlier amongst the emerging markets for the last three years. Some of the factors attracting FIIs to India are – rising hopes for strong economic recovery and good earnings growth, a weak dollar index, and the government’s stimulus measures. FII statistics have been proved pivotal in predicting the undercurrent of the market over the years. But in today’s market, it is not only FIIs that influence markets. The share of retail, high net worth individuals (HNI), and domestic mutual funds have also increased since the last year.

Prominent FIIs in India include global firms like BlackRock, Vanguard, and Fidelity. Here’s the list of 5 Most Prominent FIIs for Indian Markets:

1. BlackRock Inc.

BlackRock Inc., the world’s largest asset manager, has a significant footprint in India’s financial markets. It invests through multiple vehicles, notably iShares ETFs such as the iShares MSCI India ETF. In recent quarters, this fund alone witnessed net inflows of over $1 billion, signaling increasing investor interest in India’s economic potential. BlackRock’s investments are focused on key growth sectors, including technology, energy, and financial services, aligning with India’s digital transformation and sustainability goals.

The firm’s total exposure in India spans equities and fixed-income instruments, with a combined value exceeding $12 billion. Major holdings include stakes in companies like HDFC Bank, Reliance Industries, and Tata Consultancy Services, highlighting BlackRock’s strategy of targeting high-growth sectors. Its investment philosophy blends passive and active strategies, balancing risk through diversification.

Looking ahead, BlackRock aims to deepen its exposure in India, leveraging opportunities in renewable energy and fintech, given the country’s focus on sustainable development and digital innovation. However, global macroeconomic conditions and regulatory policies will play a critical role in shaping future inflows. As one of the largest FIIs, BlackRock’s capital movements significantly impact market sentiment, liquidity, and stock valuations in India, making it a key player in the Indian financial ecosystem.

2. Government of Singapore Investment Corporation (GIC)

The Government of Singapore Investment Corporation (GIC) is a prominent sovereign wealth fund that has established a significant presence in India’s financial landscape. With investments primarily concentrated in the real estate, technology, and infrastructure sectors, GIC has been strategically increasing its stake in key Indian companies and pursuing lucrative private equity deals.

As of 2024, GIC’s total investments in India are estimated to be around $10 billion, reflecting its commitment to the country’s growth potential. The fund has made notable investments in major companies such as Flipkart, OYO, and various real estate projects across major metropolitan areas, reinforcing its focus on sectors poised for long-term growth.

GIC’s approach goes beyond mere financial investment; it seeks to foster partnerships with Indian firms that emphasize sustainable development and innovative solutions. This strategy not only enhances its portfolio but also aligns with India’s goals of infrastructure development and digital transformation. GIC’s interest in renewable energy projects and smart city initiatives illustrates its commitment to sustainability and responsible investing.

Looking ahead, GIC plans to continue expanding its footprint in India, focusing on emerging sectors such as green technology and healthcare. By leveraging India’s demographic advantage and growth trajectory, GIC aims to achieve substantial returns while contributing positively to the Indian economy. As a long-term investor, GIC’s actions and strategies are closely watched, influencing market sentiment and investment trends within India.

3. Norwegian Government Pension Fund Global (NBIM)

The Norwegian Government Pension Fund Global (NBIM), managed by Norges Bank, stands as one of the largest sovereign wealth funds globally, with diversified investments across various asset classes. In India, NBIM has strategically positioned itself as a key player in the equity market, focusing on companies that demonstrate strong growth potential and sustainable practices. As of 2024, its investments in India are estimated to exceed $4 billion, with stakes in notable firms across sectors such as energy, technology, finance, and consumer goods.

NBIM emphasizes responsible investment practices, adhering to strict ethical guidelines that promote sustainability and long-term value creation. This commitment is reflected in its selective approach to investments, where environmental, social, and governance (ESG) criteria are paramount. The fund’s investments in renewable energy projects and companies advancing sustainable technologies illustrate its alignment with global efforts to combat climate change and foster sustainable development.

Looking forward, NBIM aims to further enhance its investments in India, particularly in emerging sectors like clean energy and digital innovation. With India poised for significant economic growth, the fund sees potential in partnering with Indian companies that align with its sustainability goals while delivering competitive returns. This strategy not only strengthens its portfolio but also contributes positively to India’s economic landscape.

As a long-term investor, NBIM’s presence in India is expected to influence market trends, attracting additional foreign capital and promoting responsible investment practices within the Indian equity landscape. The fund’s focus on sustainability ensures that its investments support both profit and positive societal impact, reinforcing its role as a responsible investor in the global arena.

4. Vanguard Group

Vanguard Group, one of the largest asset management firms in the world, has significantly expanded its investments in Indian markets through passive strategies, including ETFs like the Vanguard Emerging Markets ETF. As of 2023, Vanguard’s holdings in India cover various sectors, particularly financial services and technology. For example, it holds a 2.6% stake in Infosys, valued at over ₹13,000 crores, and a 4.99% stake in Zee Entertainment Enterprises worth approximately ₹1,225 crores.

Vanguard’s low-cost, index-based approach attracts long-term investors looking to benefit from India’s growth potential without high fees. The firm’s strategic focus includes maintaining exposure to India’s rapidly expanding digital and consumer-driven sectors. It is well-positioned to leverage India’s economic momentum as it emphasizes emerging markets to diversify its global portfolio.

Moving forward, Vanguard aims to increase its presence in India, potentially broadening its investments across other key industries as the country’s stock market matures. However, global macroeconomic factors and regulatory changes remain influential in Vanguard’s decision-making processes.

Read more: Influence Of FII and DII Activity In The Indian Stock Market

Who are DIIs?

Domestic Institutional Investors (DIIs) are entities based in India that pool funds to invest in financial markets. They primarily includes, mutual funds, insurance companies, pension funds, and other financial institutions. DIIs play a crucial role in the Indian stock market by providing stability and liquidity, especially during periods of volatility.

Unlike Foreign Institutional Investors (FIIs), DIIs are often seen as long-term investors with a vested interest in the domestic economy. They tend to invest in sectors that align with India’s growth story, such as technology, infrastructure, and consumer goods. The presence of DIIs can help mitigate the impact of FII outflows, as they have a deeper understanding of the local market dynamics.

As of October 2024, DIIs have been actively investing in the Indian stock market, contributing significantly to capital inflows. Their strategies often reflect confidence in India’s economic potential, making them an essential component of the market ecosystem. Overall, DIIs not only support market stability but also drive long-term growth through their investment choices and insights into the Indian economy.

Who are the Top DIIs in India?

There are numerous institutions including but not limited to Birla Group, Euro-specific growth funds, Sundaram Group and Reliance that have strong investing activity in the Indian Stock Markets. Infact, DIIs account for ~14% of today’s Nifty movement. Here are the Top 5 DIIs that are actively investing in India:

1. State Bank of India Mutual Fund

State Bank of India Mutual Fund (SBI MF) stands as one of the largest and most trusted mutual fund houses in India. Managed by the State Bank of India, it boasts an impressive asset under management (AUM) of over ₹5 Lakh Crore as of October 2024. The fund offers a diverse array of investment options, including equity, debt, and hybrid schemes, making it accessible to a broad range of investors

SBI MF has consistently focused on long-term growth potential, particularly excelling in sectors such as banking, finance, and technology. Its robust performance is supported by a disciplined investment strategy that aims to capture emerging trends and opportunities within these sectors. The fund is particularly noted for its ability to adapt to changing market dynamics, which helps mitigate risks while maximizing returns.

In terms of future goals, SBI MF aims to further enhance its presence in the Indian mutual fund industry by expanding its product offerings and investing in sustainable growth sectors. The fund is also looking to leverage technology to improve investor experiences and increase operational efficiencies. With a strong distribution network across the country, SBI MF is committed to maintaining investor trust and providing liquidity in the stock market.

2. HDFC Mutual Fund

HDFC Mutual Fund is a premier player in India’s asset management industry, recognized for its extensive range of investment products and consistent performance. As of October 2024, it manages assets exceeding ₹4.5 lakh crore, making it one of the largest mutual fund houses in the country. HDFC MF offers various funds, including equity, debt, and hybrid schemes, catering to diverse investor needs and risk profiles.

The fund has strategically focused on high-growth sectors such as finance, technology, and healthcare. By capitalizing on emerging opportunities within these sectors, HDFC MF has positioned itself as a reliable choice for investors seeking robust returns. The fund’s disciplined investment approach, bolstered by its research-driven strategies, has garnered a strong reputation among investors, contributing to its significant inflows. HDFC MF’s consistent performance is a testament to its rigorous analysis and risk management practices. The fund is committed to maintaining transparency and delivering value to its investors, which has helped build long-term trust and investor confidence. Additionally, the mutual fund house actively engages in investor education initiatives to enhance financial literacy and empower investors to make informed decisions.

Looking ahead, HDFC Mutual Fund aims to further diversify its investment strategies, particularly in sectors aligned with India’s growth trajectory, such as renewable energy and digital infrastructure. The fund also plans to leverage technology to enhance investor experience and streamline operations. By focusing on innovation and sustainable investments, HDFC MF seeks to adapt to the changing landscape of the Indian financial market while delivering long-term value for its investors

3. LIC Mutual Fund

Life Insurance Corporation of India (LIC) Mutual Fund is a prominent player in the Indian mutual fund landscape and a subsidiary of LIC, one of the largest insurance providers in the country. As of October 2024, LIC MF manages assets worth approximately ₹2.5 lakh crore, making it a significant contributor to the DII space. The fund primarily diversifies its investments across equities, fixed income, and hybrid instruments, catering to various investor profiles and risk appetites.

LIC MF has adopted a strategic focus on large-cap stocks, known for their stability and consistent returns. This approach not only aims to provide investors with a balanced portfolio but also plays a crucial role in supporting the overall liquidity of the Indian equity market, particularly during periods of volatility. By investing in established companies with strong fundamentals, LIC MF contributes to market confidence, which is vital for sustaining economic growth.

Looking ahead, LIC MF has outlined plans to expand its investment strategy to include more emerging sectors such as renewable energy, technology, and healthcare. This diversification aims to capture growth opportunities that align with India’s evolving economic landscape. Additionally, LIC MF is committed to enhancing its investor outreach and improving customer service through technological advancements, making it easier for investors to access their funds and track performance.

How to locate and measure FII and DII investment in Indian Stock Market?

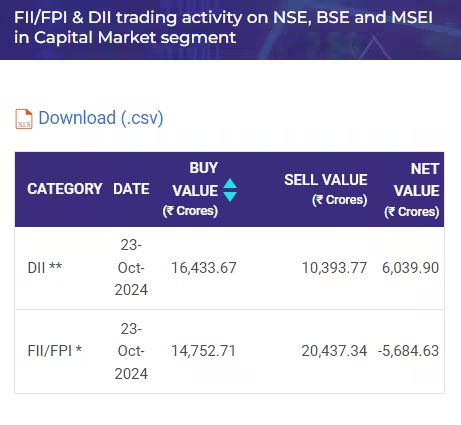

To effectively locate and measure daily FII/FPI and DII investment data, visit the National Stock Exchange (NSE) website. Once there, navigate to the section dedicated to FII/FPI and DII Trading Activity. This section provides comprehensive insights into the daily fluctuations in FII and DII investments. See image below:

FII and DII data is released daily by stock exchanges after trading hours, available on the NSE and BSE. While this data offers insights into market trends and sentiment, it cannot predict market crashes due to various influencing factors. Although FII and DII inflows/outflows can affect stock prices, other elements like company fundamentals and economic conditions are equally important. Intraday FII data may not be dependable for short-term trading; thus, combining FII and DII activity with technical analysis can enhance trading decisions.

Is high DII buying activity always a positive sign?

No, high DII buying activity isn’t always a positive indicator. While it may suggest confidence in the market, investors must evaluate the broader market environment and additional factors. Combining FII and DII data with other analytical tools and market signals is crucial for making informed trading decisions, rather than relying solely on this data.

How Do FII and DII Trading Activities Work?

FIIs and DIIs focus on generating returns for their investors by identifying promising growth opportunities. These substantial entities typically employ dedicated teams of analysts and fund managers who conduct comprehensive research and analysis before making any investment choices.

Operating at a large scale, FIIs and DIIs engage in bulk deals and block trades, which can significantly affect stock prices and overall market trends. Investors and traders can gain valuable insights by monitoring the daily FII and DII data published on stock exchanges.

Given their substantial trading volumes, the activities of these large-scale investors are closely watched by regulatory bodies such as the Securities and Exchange Board of India (SEBI), the Reserve Bank of India (RBI), and the stock exchanges. This oversight is crucial since their trading actions can influence market dynamics.

While the trading activities of FIIs are strictly regulated, requiring adherence to specific guidelines regarding investment limits and reporting obligations, DIIs enjoy comparatively more flexibility. Although their activities are also monitored, DIIs have more leeway in their investment strategies, allowing them to respond to market changes with greater agility.

What Should Act As Key Indicators To Assess Market Impact?

While FII and DII activities can indicate market trends, investors should not base their decisions solely on whether these entities are buying. A bottom-up investment strategy is advisable, focusing on companies with robust fundamentals available at attractive valuations.