Budget 2025 now allows taxpayers to claim nil valuation for two self-occupied properties. This means that homeowners can now claim value of two self-occupied properties as tax-free, removing taxation on notional rental income from a second home.

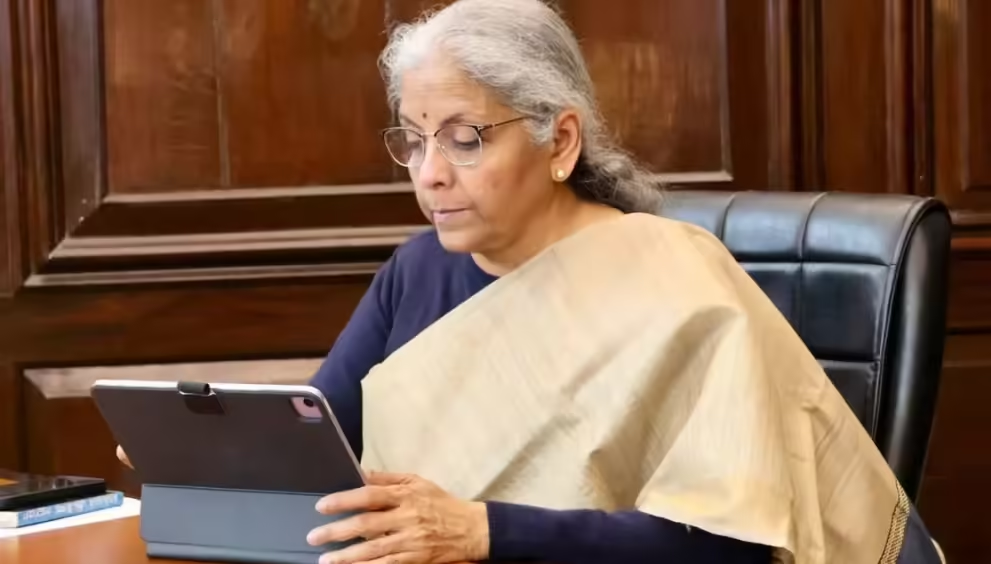

Finance Minister Nirmala Sitharaman announced in Budget 2025 the relaxation of conditions for making any two houses self-occupied properties in income tax rules. As per the announcement made in the Budget 2025 speech, “Presently tax-payers can claim the annual value of self-occupied properties as nil only on the fulfilment of certain conditions. Considering the difficulties faced by taxpayers, it is proposed to allow the benefit of two such self-occupied properties without any condition.”

The simplification of rules will help taxpayers easily file their income tax returns without any calculation as they can claim the value of any two houses as zero. The deemed calculation of house will apply only if the taxpayer has a third house.

This step minimizes tax pressures, promotes homeownership, and facilitates real estate investment, especially in second homes and Tier 2 and 3 cities. Middle-class homebuyers, landlords, and investors can now benefit from reduced tax liabilities, better affordability, and fewer compliance hassles. By simplifying financial constraints and tax rules, the budget has made property ownership and rental housing more accessible.

Also Read: Union Budget 2025: Know What Gets Cheaper, What Gets Costlier

Under Section 23 of Income-tax Act. 1961, the annual value was considered as nil for properties occupied by the owner or if the owner’s occupation was prevented by work-related obligations for upto two properties. Budget 2025, has amended the said section to simplify the house property provisions by making it easier for property owners to determine the annual value of their homes without altering the two-property limitation.

Read More: Budget 2025: Everything You Need To Know

Effective 1 April 2025, if an owner resides in his / her own property or is unable to occupy it for any reason, the property’s annual value will be counted as nil. This streamlined approach will be applicable from the assessment year 2025-26, easing the compliance for property owners.