Paytm’s entertainment ticketing business has a scale of ~300 crore in revenue and Rs 29 crore in adjusted EBITDA in FY24, Paytm cash ramps up to 10,000 crore

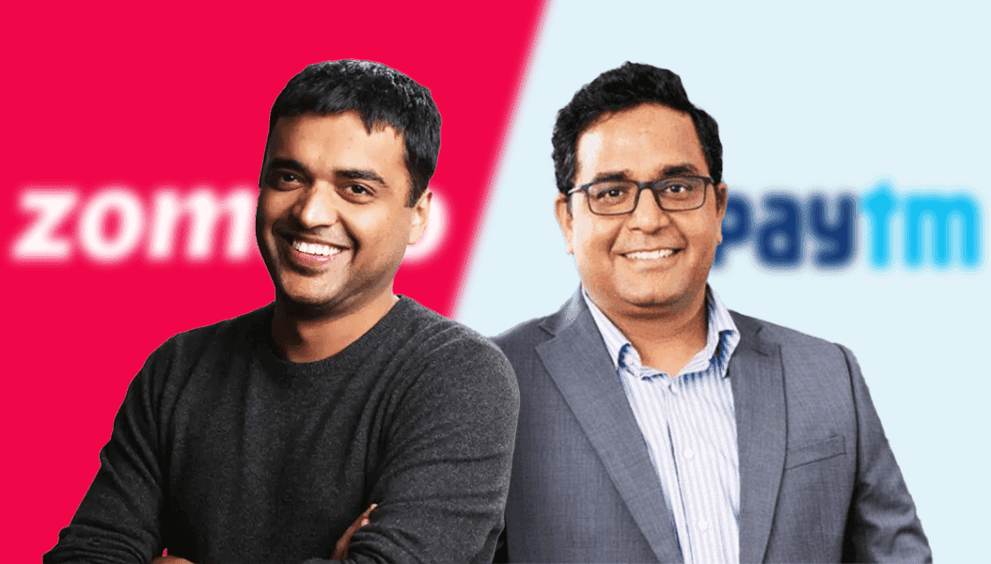

Zomato, the largest online food ordering and restaurant aggregator in India, has acquired Paytm’s ticketing and entertainment business. This acquisition is a major advancement in Zomato’s ecosystem intended to increase revenue sources and improve customer interactions. Along with this acquisition, Paytm’s cash pile has grown to an incredible ₹10000 crores, up from around 7500 crores, available for other strategic investments. Post announcement, Zomato’s listing increased by ~3% the very next day with Paytm stock price climbing up 4%.

This incorporation is a tactical action for Zomato, which aims at expanding from the food business. It includes movie reservations and event bookings among others. India’s entertainment sector has rebounded tremendously following the pandemic, with an estimated yearly growth rate of 13.7%, expected to hit ₹2.66 lakh crore by the year 2025. As consumer expenditure on entertainment is projected to grow over time, Zomato’s entry into this sector comes at an ideal moment. With such an acquisition, Zomato will be able to expand its range of services, hence providing all-inclusive solutions for food, entertainment and lifestyle.

Through bundling food delivery with ticket bookings, Zomato can create offers that attract more trading value and keep customers for longer. Also, Zomato Pro, Zomato’s loyalty program, might be expanded to include an entertainment component, thus persuading the users to involve themselves even more in its use. The deal worth approximately ₹2100 crore not only enhances Zomato’s value proposition for the consumers but also adds yet another income stream to its portfolio. Zomato plans to venture into this business with a new app named ‘District’. In contrast to the food delivery market characterized by intense competition and high operational costs, the ticketing and entertainment sector offers higher margins. Thus by tapping into entertainment market volatility due to food delivery as well as achieving a balanced revenue mix. Additionally, this acquisition enables Zomato to get data out of the entertainment business, which they can use to improve their understanding of consumer preferences and behaviors. Such data could be utilized for personalizing marketing strategies, enhancing customer targeting, and ultimately boosting sales across both cuisine products as well as entertainment services.

Paytm has been focusing on core activities such as digital payments, lending and financial services as its strategy. With increased cash flows, Paytm could invest in this growing area to compete effectively in the fast-changing world of fintech. One of the areas that would likely benefit from this cash infusion is Paytm’s lending business which disbursed loans worth ₹13,500 crore by March 2024. Moreover, considering how competitive digital payments are at present (for example, players include Google Pay or PhonePe), Paytm can also use these cash reserves for upgrading their technological infrastructure, subsidizing transaction costs or giving consumers supportive measures (such as cashback). In a market where there is high competition, these strategies could help Paytm retain its market share while attracting new users.