The Singapore central bank loosens its monetary policy for the first time since March 2020, citing ‘trade frictions’ as the reason as Trump returns to power

Singapore’s central bank eased the country’s monetary policy on Friday, having kept a tight policy stance since COVID. Post Donald Trump’s return as the US president, Singapore faces increasing trade uncertainties, being a trade dependent economy.

The Monetary Authority of Singapore (MAS) mentioned that it would focus on the exchange rate policies known as the S$NEER policy band, as opposed to the usual interest rate stance, slowing the appreciation of the Singapore dollar against other world currencies.

While most central banks use domestic interest rates to define their monetary policy, the MAS allows its currency to appreciate gradually. “Global economic policy uncertainty has risen since the October monetary policy review, mainly reflecting expectations of increasing trade policy frictions,” the authority mentioned. As the rate of currency appreciation reduces, the economy hopes to lower its borrowing rates. Furthermore, the MAS also foresees a slowed global growth in 2025, adding to its easing policy stance.

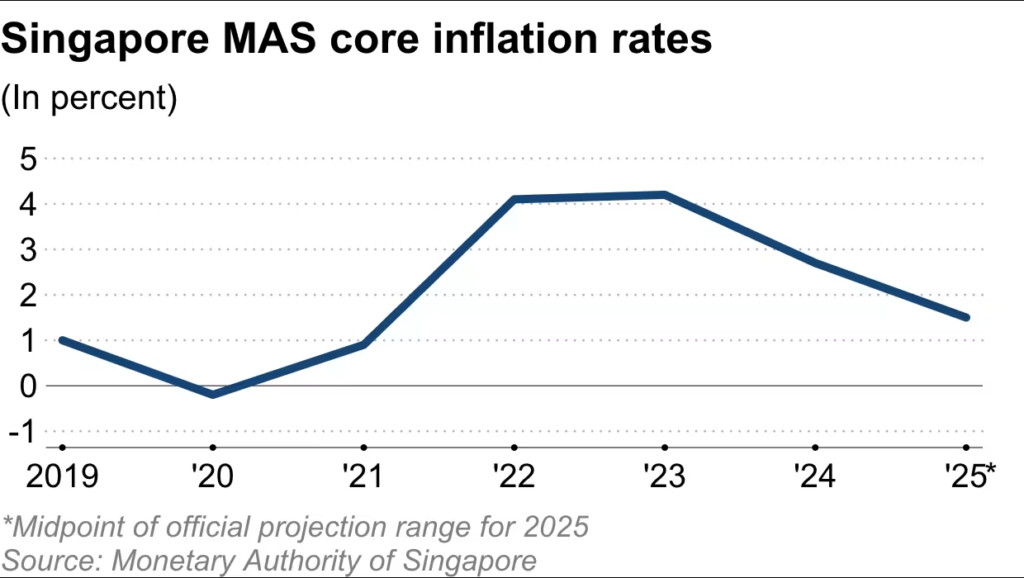

Singapore’s central bank reduced its 2025 core inflation forecast from a 1.5%-2.5% range to a 1%-2% range, in contrast to higher inflation rates in the last 2 years – 2.7% in 2024, 4.2% in 2023.

An overall price stability is necessary since Singapore’s open economy structure depends on global trade and its financial inflows and outflows through the same. As per the central bank, 40% of domestic spending is on imports, and gross imports and exports of goods and services account for over 300% of GDP. “Singapore’s imported costs should stay moderate reflecting forecasts of global oil price declines and favorable supply conditions in key food commodity markets,” the Monetary Authority of Singapore added. “While an escalation of trade frictions could be inflationary for some economies, their impact on Singapore’s import prices is likely to be offset by the disinflationary drags exerted by weaker global demand.”

Singapore also reduced its GDP growth rate forecast for 2025 to a 1%-3% band, predicting a slower pace as compared to last years’ growth rate of 4% against a target of 3.5%.

For the most part, Singapore’s growth and inflation outlook depends largely on the external environment. As the senior currency analyst at MUFG Bank, Lloyd Chan said, “I think for now, the MAS will adopt a wait-and-see approach to see more clarity from Trump’s tariff policy before deciding to act further.”