Australia’s housing market spirals as surging demand outpaces dwindling supply; Soaring prices and rents leave many struggling to find a place to call home

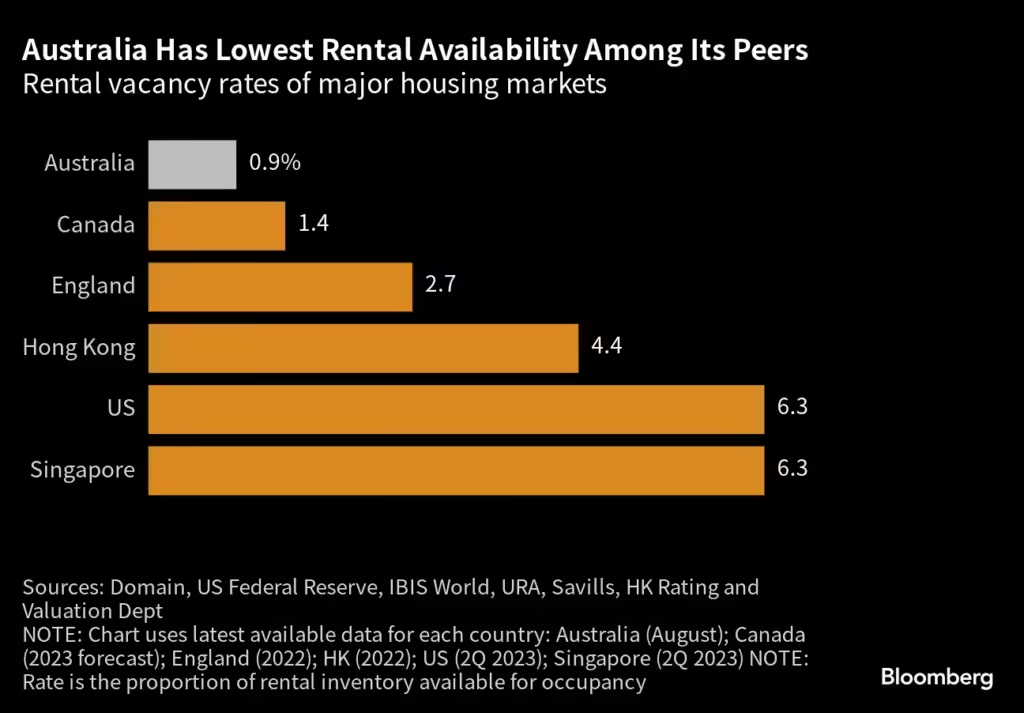

Australia’s housing market has become one of the most adverse globally due to a severe shortage of supply compared to the growing demand. Increase in population, shortage of houses for rent coupled with slow construction, both house prices and rents nationwide are skyrocketing. This has been compounded by factors such as openings of international students and skilled migrants, problems associated with the construction industry and increasing interest rates.

Based on record-high net overseas arrivals in 2023, it expects new returnees from overseas students and workers to add 2.18 million people to the population in the next five years. This puts huge pressure on the housing sector where demand is already outcompeting the supply.

As demand rises, Australia’s construction industry continues to encounter major barriers that inhibit the provision of new homes. The industry is challenged by a skills deficit, which has only been worsened by the pandemic. The influx of skilled migrants has been an issue in the past, due to which completion of houses and other construction projects is slowed and construction time has been an extra added factor due to large-scale infrastructure projects.

These challenges are further compounded by existing supply chain instability as well as recurring inflation. Likewise, the cost of construction materials has gone high, which has fixed the big construction risks to a different level. The high cost of borrowings occasioned by high interest rates has also contributed to an increase in project insolvency, particularly through the postponement or abandonment of projects.

The private sector, responsible for providing the majority of the needed housing stock, has failed to meet the demand. Currently, the federal government plans to construct 1.2 million homes, with an inclusive 97% of these houses to be constructed by private developers within the next 5 years. Nevertheless, problems in everyday housing organizations have led to the creation of a supply deficit that is increasing YoY.

That demand forecasted by the Housing Australia body that expected shortage of 115,600 units by 2027 has now risen to nearly 198,000 based on the latest population figures. This rising deficit is a straight outcome of the scarcity of labour, increasing cost of construction, and industry bankruptcy that has impaired housing construction.

As the crisis worsens, the government intervenes to reduce the pressure. Since foreign students contribute considerably to Australia’s housing demand, it will restrict international students’ intake to 270,000 – 16% less than in 2023. That cap is meant to reduce appetite for housing by arresting a rise in demand, especially among students who are scrambling for limited residential space in large cities.

However, these measures are not expected to have an immediate positive impact. Tightness in the rental market persists, meaning that most people in Australia continue to find it hard to secure decent, affordable rental homes. A conglomeration of homelessness, having been escalated by high rents and limited availability of housing units, is turning into a social issue.

Australia’s housing market has become a victim of ever-increasing demand without enough supply to meet the demand. In the current and coming years, construction industries can attest to acts of labour shortage, high material costs, and increasing interest rates, all of which make it very hard to increase construction to meet supply.