QIPs in India hit a 4-year high led by Adani and Vedanta, future prospects look positive drive by global investor interests

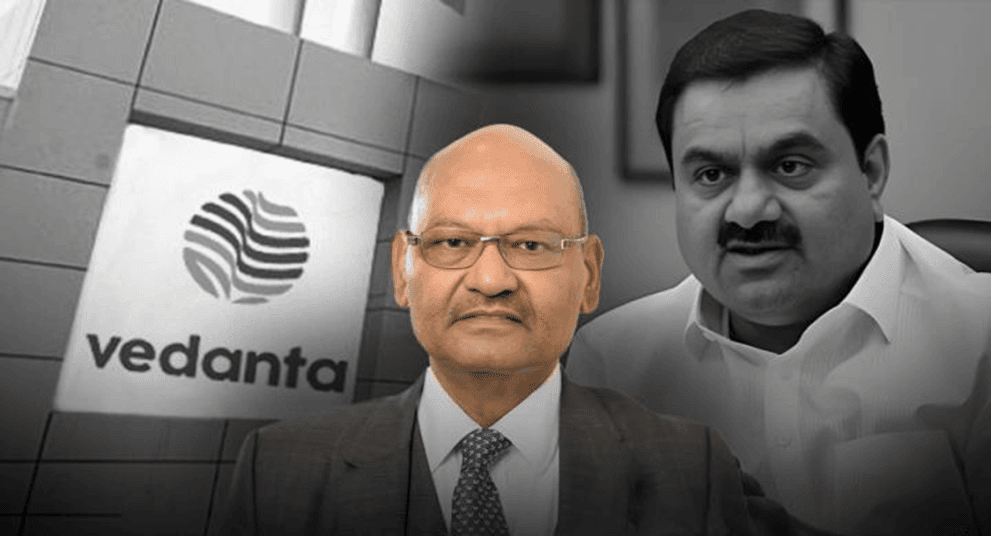

In July 2024, Adani Enterprises, through QIP, issued INR 25000 crore ($3.5 billion), which was subscribed 3x. These are to be used for repayments of debts and capital expenditure in all the group’s infrastructural and green energy sectors. Institutional investors’ interest in Adani’s QIP signals long-term confidence despite operational and corporate governance issues and market swings caused by massive debt.

Vedanta, a mining and metals major, sold about 19% stake to international institutions in May 2024 to increase INR 10,000 crore ($1.2 billion) through a qualified institutions placement; mostly to retire existing debt and to finance the ongoing project in metals and mining. Vedanta’s IPO is at a time when the company is steering towards managing its debt, which was around $6.4 billion as of FY 2023-24. According to Vedanta’s QIP result, institutional investors overcame their bearishness, demonstrating confidence in the long-term value creation story.

The capital markets of India have seen their largest business since 2020. This resurgence of QIPs demonstrates institutional investors have an appetite for exposure to Indian stocks, particularly to sectors like infrastructure, energy and mining. By August 2024, Indian businesses had raised almost ₹60,000 crore ($7.3 billion) from QIPs, the most since 2020. With the total raised through QIPs in the calendar 2023 being around ₹35,000 crore, this is certainly a significant increase. It is largely determined by the availability of the market, more favorable attitudes from investors and companies wanting to pay down their debt or raise more capital to expand.

Several factors have contributed to the resurgence of QIPs in 2024. The Indian stock market has emerged strong with the Nifty 50 index rising ~10 % YTD. This bullish trend has boosted fundamentalists to source capital from the capital markets for working capital. There’s also an increase in institutional appetite with institutional investors, local and foreign, eager to buy Indian equities, particularly in sectors associated with the long-term development agenda of India, such as infrastructure, energy and natural resources. Big players like Adani and Vedanta, have embarked on a deleveraging process. They try to achieve company efficiencies to gain a positive outlook on financial adjustments, increase in credit scores, and low-interest costs that will increase the chances of higher profitability.

Fluctuations in the global and domestic interest rates will dictate the future path of the QIPs. If central banks, especially the RBI, sustain a higher interest rate to tame inflation, then it becomes costly to borrow; hence QIPs become more favourable than debt financing for equity issuances. The outcomes of future QIPs will also be influenced by such factors as the ability and willingness of the issuers to adopt sound corporate governance standards. The awareness of investors of governance problems is growing, and companies with clear and sound governance structures would attract more attention. The sectors such as energy and resources will see sustained demand as the economy recovers post-COVID and more infrastructure creation and urbanization are seen, thereby continuously fueling the need for capital through QIPs.

In all, total QIPs in India have reached a level of 4-year high with Adani and Vedanta at the helm. Towards the future, the QIPs appear to be promising, with more and more global institutional investors interested in investing in Indian stocks, particularly in infrastructure, energy and mining sectors. The future source of funds from QIPs will persist, but at the same time, it largely depends on international and local interest rates, corporate governance and post-pandemic economic activity.