With a staggering 268 IPOs on NSE raising ₹1.6 lakh crore, India leads the Asian IPO ranking; NSE becomes the top global stock exchange by IPO proceeds in 2024

India transcends China in terms of company listings in 2024 for the Asia region, as positive investor sentiment prevails and domestic investments increase. This IPO boom resulted in seven entrepreneurs entering the billionaire league with many of them investing with a bullish sentiment in the renewable energy industry. The Indian IPO market has been dominated by a surging number of small and medium sized businesses in the past three years. Out of 268 IPOs in 2024 itself, the number of SME IPOs were twice the number of mainboard IPOs.

Big listings like Hyundai Motor and Swiggy fueled this growth, leading India to become the second largest equity fundraising market after the United States, creating history, according to 2024 data from Dealogic. India’s National Stock Exchange also leaves behind last years’ largest IPO fundraising exchange, the Shanghai Stock Exchange, becoming the top global stock exchange by IPO proceeds in 2024.

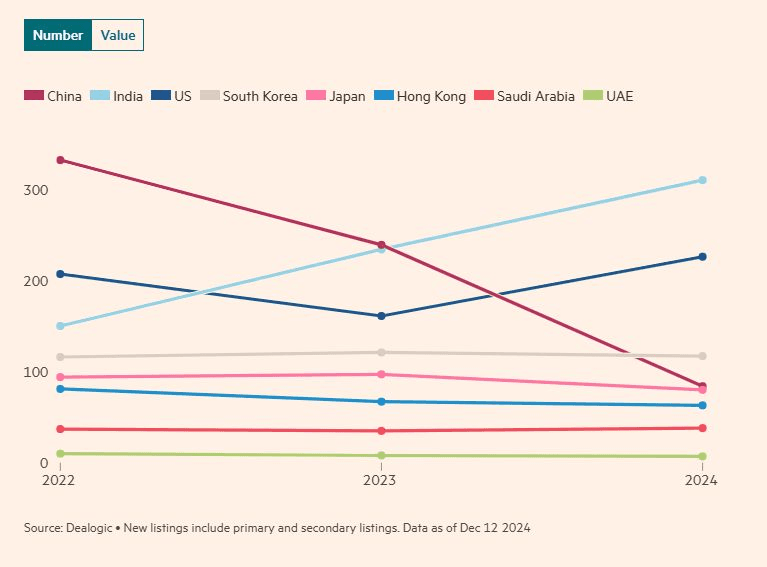

While the number of new listings in China decline, mainly due to tightening of country regulations in the sector, India sees a consistent rise in listings in the last three years, dominating the ranking by number.

Companies benefit from high valuations, especially SMEs, while retail investors flock to invest, aiming for short-term profits.

A Bombay based banker comments, “Obviously the number of transactions has gone up but the average ticket size per transaction is down about 75-80 per cent in the last two years. Now, what that tells me is, companies are thinking, ‘run for the hills, let’s try to cash in as quickly as we can, whatever we can while market conditions remain supportive’.”

But concerns of an economic slowdown derailing this growth in IPO listings persists. With weaker QoQ earnings reported by companies, and the nation’s GDP reaching a 2-year low to 5.4%, foreign investors have become skeptical of India’s equity market. They pulled out a combined $13.5 bn in October and November from the Indian stock market, with a record amount of $11 bn in the former month itself.

However, bankers are of the opinion that this excitement in the IPO market is likely to continue in 2025. As another banker stated, “Not to comment on the quality of the offerings, there is enough activity lined up so long as the markets are supportive and the liquidity is there. Fair to say that the first two quarters of 2025 will see no change from where we are right now.”