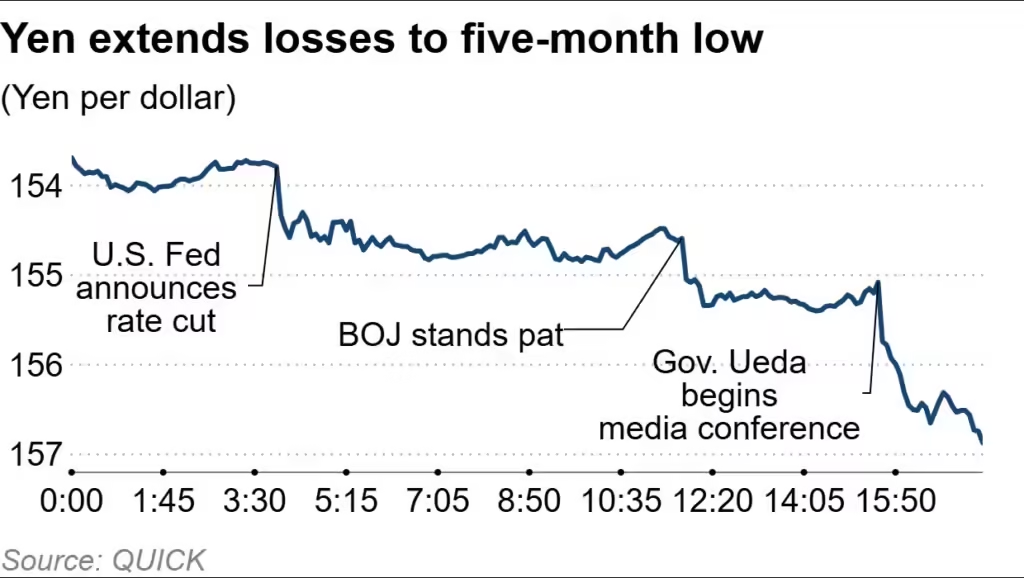

Yen continues to fall, hitting a five month low at 157 per dollar as BOJ keeps interest rates steady; analysts expect delayed rate hikes in Japan while Fed slashes rates for the third time this year.

The monetary policy between Japan and US continues to diverge as the yen depreciates further following BOJ’s decision to keep interest rates steady at 0.25%. Following the initial announcement, the currency fell to 155 to the dollar, tumbling down further to 157 at one point. This gap is likely to continue since the Fed has reduced its target rate to 4.25%-4.5% and has expressed caution to further rate cuts in the near future.

Bank of Japan Governor Kazuo Ueda said little over concerns about the weakening currency and put emphasis on the data on annual wage rise negotiations before deciding on any monetary policy changes. He also mentioned that this would be a crucial data point to achieve a sustained 2% inflation in the economy. The Sumitomo Mitsui Banking Corp’s chief foreign exchange strategist, Hirofumi Suzuki, stated, “The comment about wanting to assess the spring wage negotiations or wage trends seemed somewhat cautious.”

While this move was expected by the nation’s stock market participants, market analysts were divided on the timing of the hike between January and March. With Ueda’s comments and the central bank’s decision, sentiments changed with analysts now speculating a rate hike in March instead of January.

There is also speculation by few market analysts that Governor Kazuo Ueda might be trying to drive politicians and lawmakers, including Prime Minister Shigeru Ishiba, who have historically been unwelcome to interest rate hikes, to seek a rate rise by allowing the currency to depreciate.

Source: Financial Times – QUICK

In order to normalize Japan’s traditionally unconventional monetary policy, Ueda implemented changes to lift interest rates out of the negative territory accompanied with a halt on purchase of government bonds and company shares in March. A 25 year review of the same released by the BOJ brought into view both the positive and negative impacts of such unconventional programs. While economic activity and prices improved, the government bond market worsened.

Also Read: Yen Weakens to 153 per Dollar, Japan Warns of ‘One-Sided’ Currency Shifts

With core inflation at 2.3% in October, Japan’s inflation-adjusted real interest rates remain deeply negative, keeping monetary policy accommodative. While this strengthens Ueda’s approach to normalize monetary policy, it has the downside of weakening the currency further. Some analysts signal that the yen may fall as low as 161 to the dollar, a 37 year low for the economy.

The BOJ projects two major concerns – momentum of wage growth and consumer inflation since a weaker Chinese economy has led to a fall in business earnings and change in stock market sentiment caused by a rate hike.