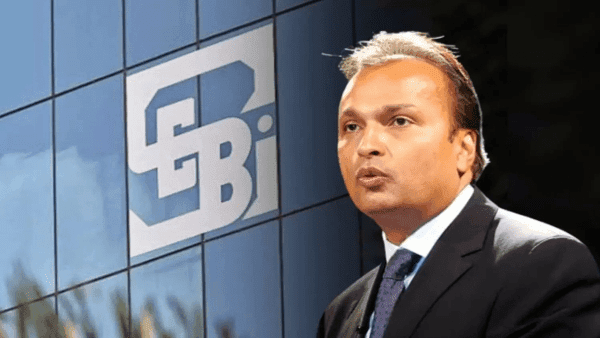

SEBI’s five-year ban on Anil Ambani for financial misconduct, signals stricter corporate governance in India

Anil Ambani, one of the most successful industrialists in India, felt the heat when the Securities and Exchange Board of India passed an order restraining Ambani and 24 other entities from the securities market for five years. The market regulator also imposed a fine of ₹25 crore on Anil Ambani. This decision arises from some company’s acts, such as embezzlement of funds, irregular expenditures, manipulation of accounts, etc. This ban has serious ramifications for Ambani and his businesses as well as the remaining financial market in India.

An extensive financial fraud case made SEBI open an investigation on Anil Ambani and the companies linked to him. Common to these allegations is the mass use of financial statement manipulation, where it was revealed that Reliance Home Finance and Reliance Commercial Finance, which are part of Reliance ADA Group, engaged in manipulation of their books through overstating revenues and understating liabilities. In addition, there were accusations of mishandling; this was on aspects of money that were appropriated from investors through bonds and other securities for purposes not disclosed to investors. In several cases, SEBI found out that these funds were either utilized for financing the operations of other group companies or given to other entities in the group to meet their liabilities and not for the business of the intended form. Also, SEBI claimed that Ambani and his cronies manipulated certain group company stock prices to portray the stock market as stable and buoyant while most of the companies were insolvent.

As per the current situation of Reliance ADA group of companies’ 2020 financial crisis, it has faced many financial issues; its total debt is around ₹1.7 lakh crore ($23 billion); out of the total amount, Reliance Communications’ liability is ₹46,000 crore. The latter went bankrupt in the year of 2019 after free-falling its stock price from ₹ 844 in 2007 to list below ₹1 per share, erasing billions of the shareholders’ wealth. Worsening these challenges, Reliance Capital failed to meet its bond requirements in 2019, and the group’s financial credibility shrunk, hence lowering its credit ratings by the credit rating agencies. These financial problems were observed in the Indian stock market, particularly after the ban on Anil Ambani, where the Reliance ADA group of companies suffered, including a more than 10% decline in Reliance Power in a single trading session. This led to a general market selling especially affecting firms that were thought to have issues in corporate governance.

The ban has dented the confidence of investors, especially promoter-controlled firms with low standards of corporate disclosure. Moreover, SEBI’s action against Ambani is likely to spur more stringent corporate governance changes and companies may undergo a more thorough scrutiny to ensure that it reflects the real status of their financial health. Creditors to the Reliance ADA Group are expected to face severe difficulties in their efforts to recover their outstanding dues; with several of the group companies now under the process of insolvency.