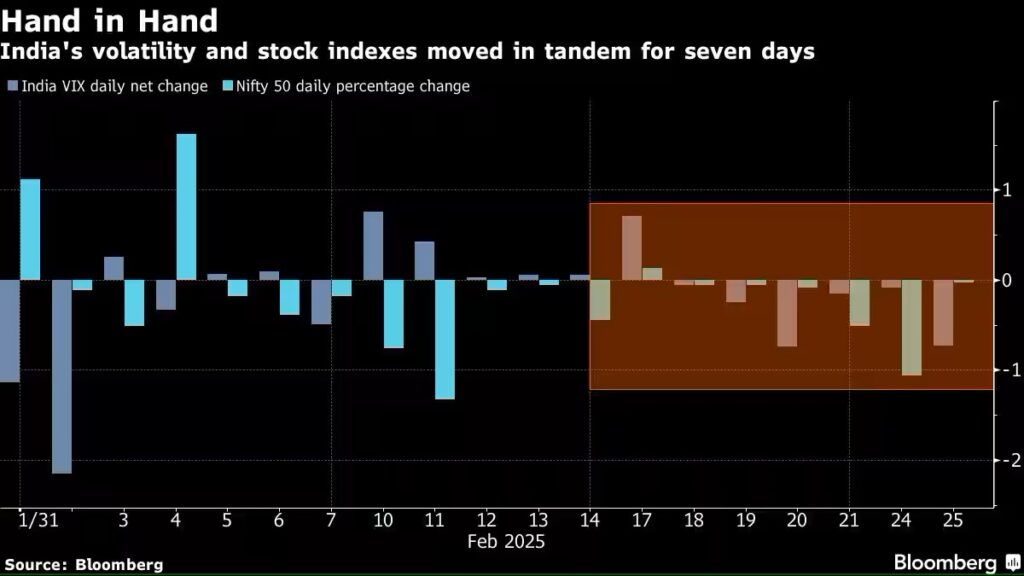

In a rare trend, Nifty 50 and India VIX have moved in sync for seven consecutive days. This unusual pattern hints at shifting market sentiment, potential stability in large caps, and fresh opportunities for investors.

In an uncommon market phenomenon, the Nifty 50 Index and India VIX (Volatility Index) have been moving in tandem for seven straight days, a rare alignment that has occurred only about 30-40% of the time historically. Typically, these two metrics exhibit an inverse relationship—when market uncertainty rises, the volatility index climbs while equities fall.

However, this synchronized movement suggests changing market sentiment, particularly towards large-cap stocks. With the broader Indian markets facing valuation concerns and mid-cap stocks witnessing sharp corrections, institutional investors are reassessing their positions.

This trend may signal a stabilizing phase for heavyweight stocks, even as mid- and small-cap segments experience turbulence.

Nifty 50 and India VIX: Breaking the Norm

The Nifty 50 Index lost 14% since September when fears over elevated valuations and dwindling growth caused investor doubt to intensify. During this time, India VIX fell, a measure that implies the level of options-based hedging was not needed as much. In older and established markets like in the US, traditionally the S&P 500 Index and Cboe Volatility Index (VIX) also reverse nearly 80% of the time. In India, the Nifty 50 and India VIX follow the same pattern but have now broken this trend.

This trend was seen for the last time in September 2021, a time when the Nifty 50 was approaching a long-term high. Market participants are now arguing whether this uncommon phenomenon is an indication of an upcoming market upturn or an extension of the current decline.

Mid and Small Cap Stocks Take a Hit

Since September 26, 2024, mid and small cap stocks have taken a much bigger hit than their large-cap counterparts. The Nifty Midcap 150 Index has declined over 18%, reflecting investor caution towards high-growth, high-valuation stocks in a tightening financial environment. As a result, hedge funds and institutional investors have shifted focus from large-cap risk management to mid- and small-cap hedging.

Sonam Srivastava, CEO of Wright Research, noted that her firm switched to hedges on mid-cap stocks last week, reinforcing the belief that large-cap names may remain more resilient even if the market continues to correct.

Market Experts Turn Bullish

Despite the broader market correction, global financial institutions are showing renewed confidence in Indian equities.

Citigroup Inc. upgraded Indian equities from neutral to overweight, citing “meaningful upside” as valuations appear less demanding.

Morgan Stanley expects the Indian market to resume its outperformance against global peers, arguing that the country’s soft economic growth patch is behind us.

Invesco strategist David Chao highlighted Indian stocks as attractive long-term structural bets due to their growth potential.

This renewed optimism comes as concerns over India’s steep valuations and corporate earnings slowdown begin to ease.

The Global Perspective: How India Compares

The unusual behavior of India’s benchmark index mirrors trends seen in certain global markets but differs significantly from the norm in Western economies.

United States: The VIX and S&P 500 typically move in opposite directions about 80% of the time. When both move together, it is often a sign of market stress or uncertainty.

Europe: European market indices tend to mirror the US pattern, with the volatility indices rising in times of market decline.

Hong Kong: The Hang Seng Index and HSI Volatility Index have gone against global trends, both in the same direction on 54% of days of trading in 2024, and more than 60% in 2025 up until now.

This indicates India’s markets are following a short-term divergence from historic patterns, potentially creating novel investment opportunities.

What Lies Ahead?

As large-cap stocks show resilience and key financial institutions become bullish, the central question now is: Will the market stabilize or keep correcting?

Investors will look closely at forthcoming corporate earnings releases, macroeconomic statistics, and international financial trends to assess direction. At least for now, synchronized action of Nifty 50 and India VIX is an elusive phenomenon, generating speculation about large caps driving a turnaround with mid- and small-cap stocks still adjusting to the new market reality.