BSE share price and Angel One shares declined as much as 10% each, Groww shares declined 9.6%, and IIFL Finance stock price fell 4.9% after FM Sitharaman announced proposal to raise securities transaction tax on futures and options trading.

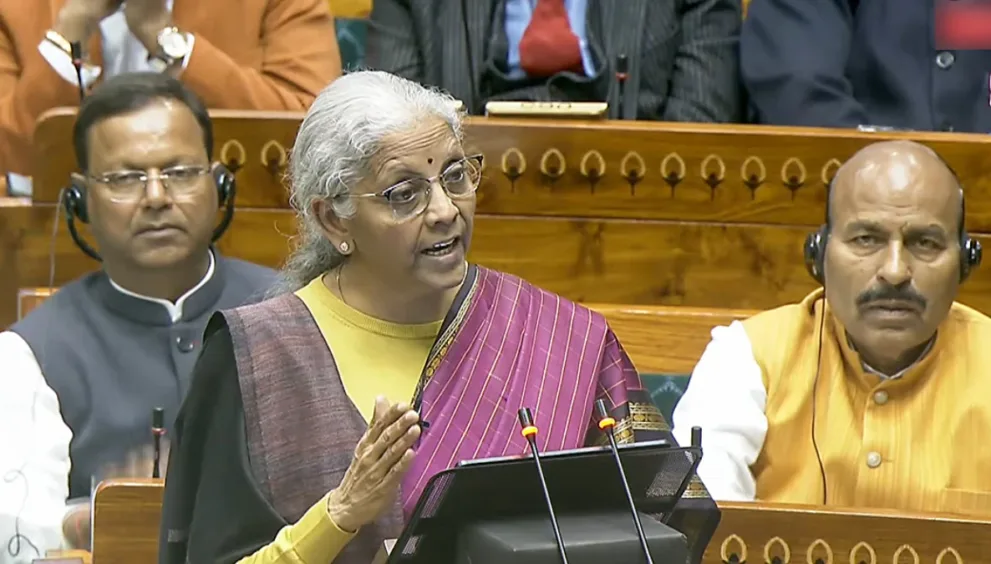

Finance Minister Nirmala Sitharaman, in her Budget 2026 speech, proposed to increase Security Transaction Tax (STT) on Futures & Options (F&O) transactions.

FM Sitharaman proposed to raise the STT by 150% on futures to 0.05% from 0.02% and by 50% on options transactions to 0.15% from 0.01% earlier.

“To provide reasonable course correction in F&O segment in the capital market and generate additional revenues for the Government, it is proposed to raise the STT on Futures to 0.05% from present 0.02%. STT on options premium and exercise of options is proposed to be raised to 0.15% from the present rate of 0.1% and 0.125% respectively,” said Nirmala Sitharaman in her Budget 2026 speech.

What is STT?

Securities transaction tax (STT) is a tax imposed on the value of securities transactions on recognised stock exchanges in the country. It applies to trades in equity mutual funds, equities, futures and options. STT is collected when the transaction occurs, regardless of the investor making a profit or loss.

When was STT introduced in India?

STT was introduced in India on October 1, 2004. It was meant to replace the long-term capital gains (LTCG) tax, curb evasion in equity and derivatives trades and simplify tax collection.

However, the Union Budget 2018 reintroduced LTCG on listed equities, while STT remained in place.

Why does STT bother traders?

Investor concerns have increased ever since a sharp rise in STT was announced in the previous Budget.

The tax on the sale of options was increased from 0.0625% to 0.1% of the option premium. Meanwhile, futures trades now receive 0.02% of traded value, which is up from 0.0125%.

When a person buys or sells an equity, derivative contract or mutual fund, they are required to pay a nominal charge on every transaction, which is STT.

However, the previous Budget also increased capital gains tax, with LTCG tax rising to 12.5% from 10% and short-term capital gains (STCG) increasing to 20% from 15%.

Brokerages and asset managers are of the view that the cumulative effect dampens the appeal of equity-linked products, especially for active traders.

An investor is required to pay LTCG tax when they hold equities of a firm for over a year. Any holding period less than 12 months receives STGC tax.

DE’s Opinion:

Overall, while the STT hike may help boost tax collections, it risks dampening trading volumes and could slow tactical FPI participation. This could cool derivative activity and lead to a reduction in volumes. The intent appears to be volume moderation rather than revenue maximisation.