Foreign investors have recently begun selling Indian bonds due to rising U.S. yields and inflation concerns. However, high yields and upcoming inclusion in global indices like JPMorgan and FTSE Russell are expected to renew interest in India’s bond market.

Rising U.S. yields and inflation concerns have recently led to the first net outflow from Indian bonds since April. However, high yields, stable currency, and upcoming index weight increases in JPMorgan and FTSE Russell indices are expected to renew investor interest in India’s resilient bond market.

Decline in Foreign Investment in Indian Bonds

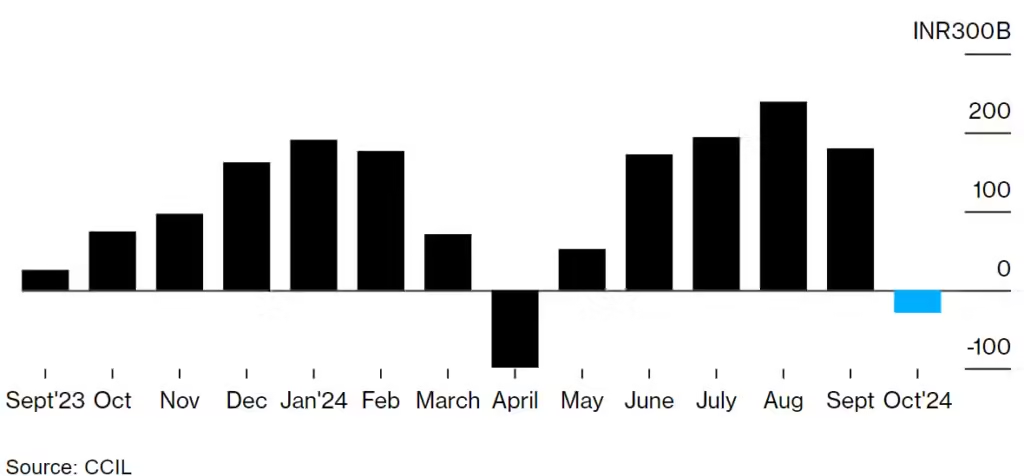

In October, foreign investors began net-selling Indian bonds for the first time since April, primarily due to rising U.S. Treasury yields and concerns over local inflation. The climb in U.S. yields is reducing the relative yield advantage of rupee-denominated bonds, typically appealing to overseas investors for their higher returns. Specifically, the sale focused on Fully Accessible Route (FAR) bonds, leading to approximately INR 28 billion ($333 million) in outflows, according to Clearing Corporation of India data. This dip in interest comes despite India’s strong overall bond performance, driven by inclusion in global indices such as JPMorgan’s EM bond index and FTSE Russell’s emerging market debt gauge.

DBS Group economists view the recent selloff as a temporary trend, noting that Indian bonds still offer some of the highest yields among emerging markets. India’s bond performance ranks highly, second only to Malaysia in Asia for local currency emerging markets, showing a 7.7% return year-to-date. With foreign inclusion in major indices, India’s visibility and appeal remain strong, particularly as the country’s weight in the JPMorgan index continues to rise monthly through March. Once yields stabilize, foreign demand is expected to rebound, bolstered by India’s promising economic outlook and the rupee’s relative stability.

Resilience and Strong Returns in Emerging Markets

Despite recent outflows, Indian bonds have shown resilience and strength among Asian emerging markets, returning an impressive 7.7% in 2024. This positive performance is supported by India’s stable rupee, which has provided some buffer against global currency fluctuations, and attractive yields that set Indian bonds apart in a competitive landscape. Rising U.S. yields have slightly narrowed the spread advantage, but India’s high yields still appeal to risk-adjusted investors, even amid rising global rates.

Moreover, India’s inclusion in major bond indices, such as JPMorgan’s Emerging Market Bond Index and FTSE Russell’s government debt gauge, has amplified international visibility and encouraged inflows. The steady monthly increase in India’s weight within JPMorgan’s index, scheduled through March, is expected to bring a steady stream of capital. This has positioned Indian bonds as a compelling choice for foreign investors seeking stability and growth within emerging markets. Thus, despite near-term headwinds, Indian bonds continue to offer a favorable profile in the broader context of Asia’s emerging markets.

Index Inclusions Support Long-term Demand

The inclusion of Indian government bonds in JPMorgan’s Emerging Market Bond Index and FTSE Russell’s government debt gauge is forecasted to bolster foreign investor interest. As India’s weight within these indices incrementally increases through March 2024, the structural demand for Indian bonds is expected to grow. This gradual rebalancing enhances liquidity and reinforces India’s presence in global fixed-income markets, where it’s recognized for its stability and high yields.

Indian bonds are currently the highest yielding in the region, making them particularly appealing for investors amid volatile global interest rates. The indices’ gradual acceptance of rupee-denominated bonds also aligns with broader efforts to globalize India’s financial markets, thereby attracting international capital more consistently. Such developments signal a potential turning point, where renewed demand could follow as major institutional investors allocate more capital towards India’s debt markets, driven by the unique benefits of index inclusion. In the coming months, consistent demand for Indian bonds could provide a buffer against short-term outflows, positioning India as a stable destination within emerging market portfolios.