As trust in fiat currencies weakens, central banks are turning to gold—now the second-biggest reserve after the dollar—to protect their wealth from geopolitical risks and financial system shocks.

In a world where financial systems are being stress-tested daily—by war, inflation, trade tension, and sanctions—it’s no wonder central banks are looking for something solid.

Literally.

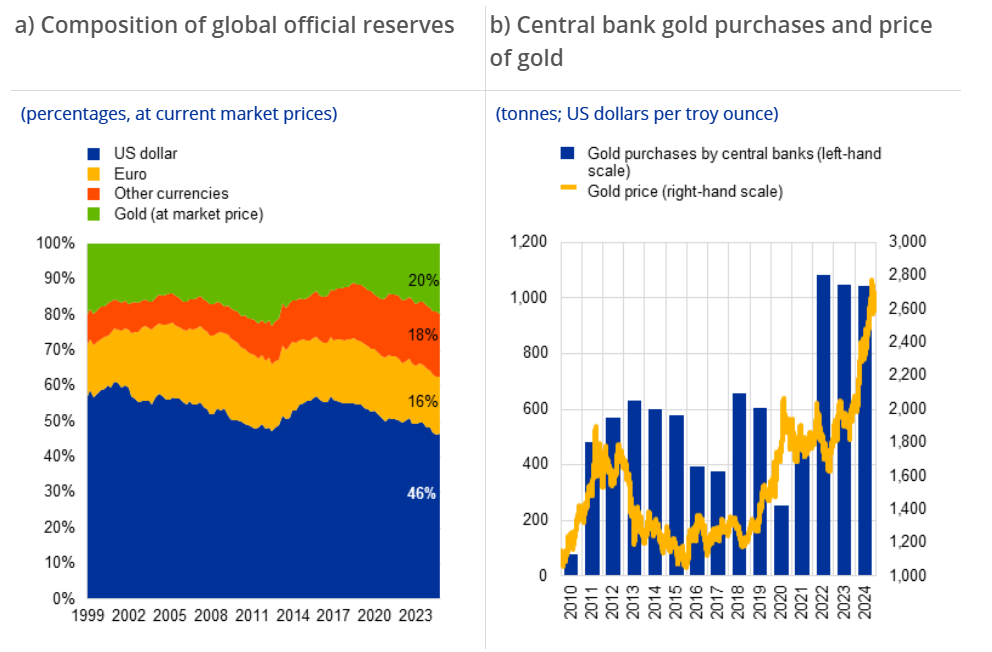

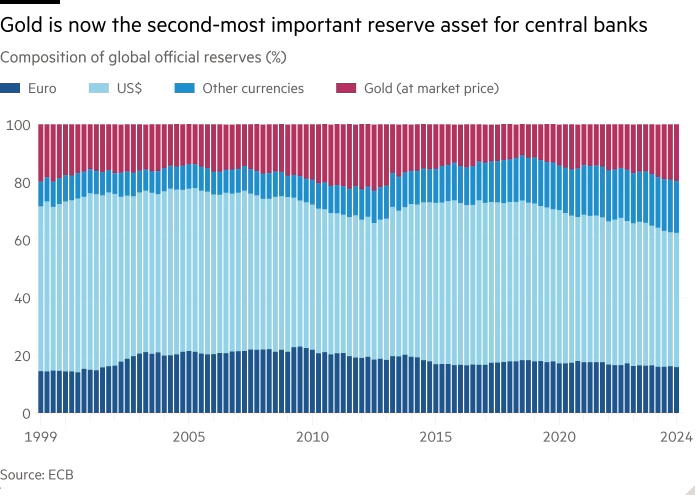

For the first time in decades, gold has overtaken the euro to become the second-most held global reserve asset, per the latest update by the European Central Bank. This is a signal of a growing inclination among central banks to diversify from fiat currencies, as a hedge against geopolitical uncertainties.

Why Is This a Big Deal?

This shift is more than just a reshuffling of reserve charts. It’s a window into how global power dynamics and financial priorities are evolving. Gold now accounts for 20% of global official reserves, nudging past the euro at 16%. The U.S. dollar still leads at 46%, but even that grip is slowly loosening.

So what’s really going on? Why are central banks—those famously conservative institutions—piling into a 5,000-year-old shiny rock?

Here are 3 major reasons Central Banks are buying gold like it’s 1979.

1. Geopolitical Insurance

The war in Ukraine changed the game. When Russia’s dollar and euro reserves were frozen overnight, it spooked a lot of other countries—especially those outside the Western alliance. The message was clear: your assets are only as safe as your politics.

Gold, on the other hand, isn’t subject to sanctions. It can’t be blocked, frozen, or devalued by another country’s decision. For central banks, especially in Asia and the global South, that makes it feel a lot like geopolitical insurance at a time of financial volatility.

2. Shift from Fiat Currencies

Fiat currencies—especially the euro—just aren’t what they used to be. The eurozone’s slow growth, policy fragmentation, and repeated crises have chipped away at confidence. Meanwhile, the dollar, though still dominant, is quietly slipping in share too.

Instead of swapping one currency risk for another, central banks are going back to basics, opting for traditional hard assets. Gold is finite, universally accepted, and doesn’t rely on any one government’s policies. It’s old-school, but it works.

3. A Hedge in Uncertain Times

From inflation and rate hikes to volatile markets and debt crises, the global economy has been a rollercoaster. Gold acts as a stabilizer when everything else feels shaky. It doesn’t yield interest, but it also doesn’t default.

And clearly, central banks agree—2024 marked the third straight year of buying over 1,000 tonnes of gold. This is double the annual amount bought in the 2010s, and accounts for almost 20% of the total global annual production. That’s not just a hedge, it’s a strategic use of currency as a store of value.

Who’s Leading the Shift?

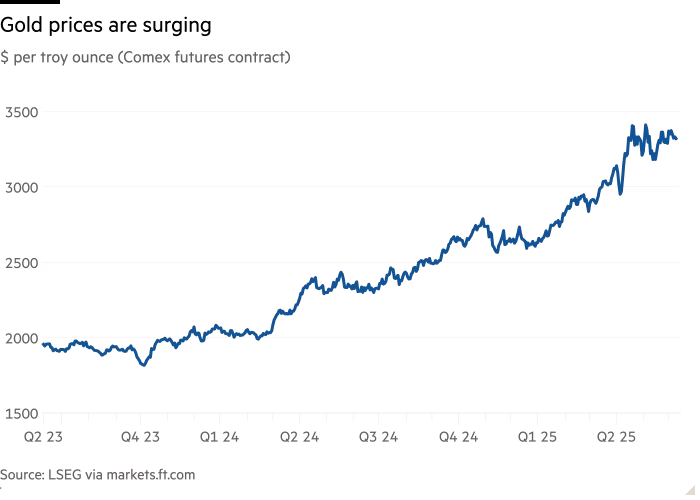

“Central banks worldwide now hold almost as much gold as they did in 1965,” the ECB report said. Big emerging economies are at the front of the line. Think China, India, Turkey, Poland—countries that are both economically ambitious and politically cautious. One of the reasons for the spike in global foreign reserves of gold was the 30% surge in gold prices last year. As of this year, prices have increased another 27%, touching a $3500 per ounce historic high.

“This stockpile, together with high prices, made gold the second-largest global reserve asset at market prices in 2024 — after the US dollar,” the ECB said.

According to a survey of 57 central banks that held gold last year, emerging markets and developing nations were motivated by worries about sanctions, anticipated changes to the global monetary system, and a desire to become less reliant on the dollar.

A poll of 57 central banks that held gold last year also found that rising markets and developing countries wanted to hold gold because they were worried about sanctions, thought the global monetary system would change, and wanted to depend less on the dollar.

What Does This Mean for Investors?

Although gold has historically decreased in value in tandem with increases in the real yields of other assets, this long-standing relationship has dissolved since early 2022, as investors are now more interested in gold as a hedge against political risk than inflation.

Gold’s comeback isn’t just a central bank story. It’s a signal. If the institutions managing trillions are rebalancing away from fiat and toward gold, it might be time for investors to consider whether their own portfolios reflect this new reality.

In a world where currencies can be politicized and markets can turn on a dime, gold is increasingly being seen not just as a hedge—but as a core asset. While the US dollar leads, its dominance is being slowly challenged; that too by a traditional asset that doesn’t directly fluctuate depending on fiscal and monetary policy decisions.