Aayush Wellness stock’s 900%+ rally smells of retail manipulation. Here’s why investors should stay miles away.

In an era where financial literacy is just beginning to find ground among retail investors, stocks like Aayush Wellness Ltd (BSE: 539528) are pulling off the oldest trick in the book: pump, hype, dump, repeat. What started as a quiet, unheard-of microcap stock has now turned into a so-called “multibagger healthcare miracle” on paper. But if you scratch the surface, the story is less of a wellness success and more of a retail investor graveyard in the making.

Let’s decode the scam disguised as success.

A Stock That Refuses to Fall – Because It Can’t

Aayush Wellness has surged from ₹16.81 to ₹183.85 per share in under a year, locking in upper circuits for over 35+ straight sessions and generating 972%+ returns in 52 weeks. It’s clocked a ridiculous 11,000% gain in three years, turning into the “multibagger everyone missed out on.”

But here’s the twist: it isn’t about strong financials or innovation. The rally is mostly built on liquidity vacuum, psychological traps, and false narratives.

With no sellers in sight and 100% delivery volume, the stock has been floating on unrealistic demand, a textbook manipulative setup where insiders or operators dry up liquidity and trigger buying hysteria.

So What Does the Company Actually Do?

According to official sources, Aayush Wellness is in the herbal pan masala, candies, and FMCG space. Recently, media headlines screamed about the company’s grand entry into the diagnostic testing and tele-consultation business.

Their newest buzz? “Health ATMs” launching in Mumbai and Virar. Sounds futuristic. Except, there’s little proof of scalability, demand, or execution. These expansions appear more in press releases than in actual performance metrics.

The Numbers Don’t Lie, But They Do Caution

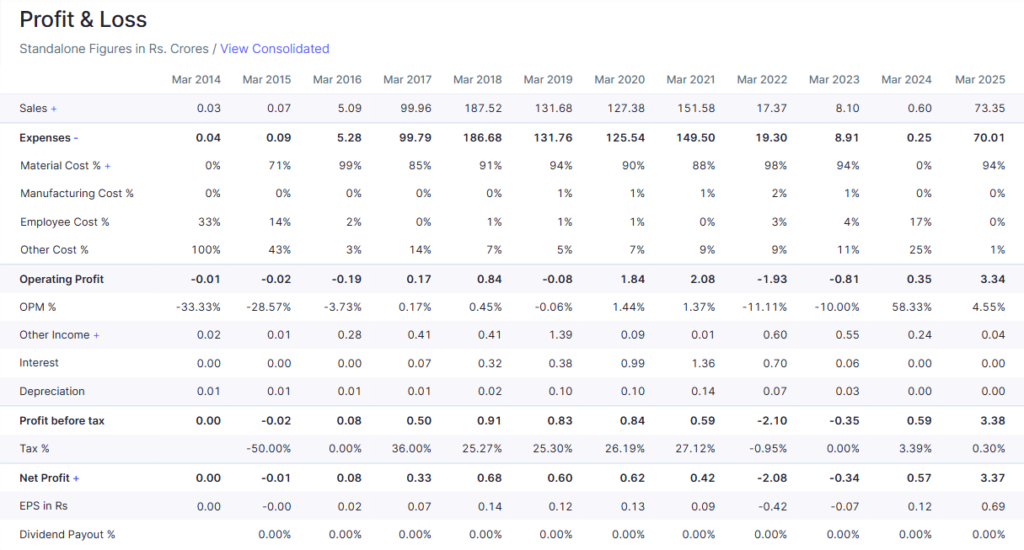

Let’s do a quick health check on Aayush’s finances (FY25):

– Revenue: ₹73.35 Cr

– Net Profit: ₹3.37 Cr

– EPS: ₹0.69

– P/E: ~275×

– P/B Ratio: ~110×

Expenses stand at ₹70.01 Cr., which divides as:

– Material Cost: 94%

– Manufacturing Cost: 0%

– Employee Cost: 0%

– Other Costs: 1%

Now let that sink in.

The stock trades at venture-capital startup valuations without being one.

A P/E of 275 with no promoter holding, no institutional ownership, and questionable revenue sustainability? That’s not just overvalued, it’s practically screaming “Get out before the lights go off.”

What’s worse? Tip messages circulated to thousands of retail investors boldly claimed the company was “debt-free”—when in fact, internal balance sheets show otherwise.

Deliberate misinformation to lure uninformed investors is financial fraud 101.

The Pump: SMS Scams, Retail Hype, Media Buzz

Here’s where it gets dirty.

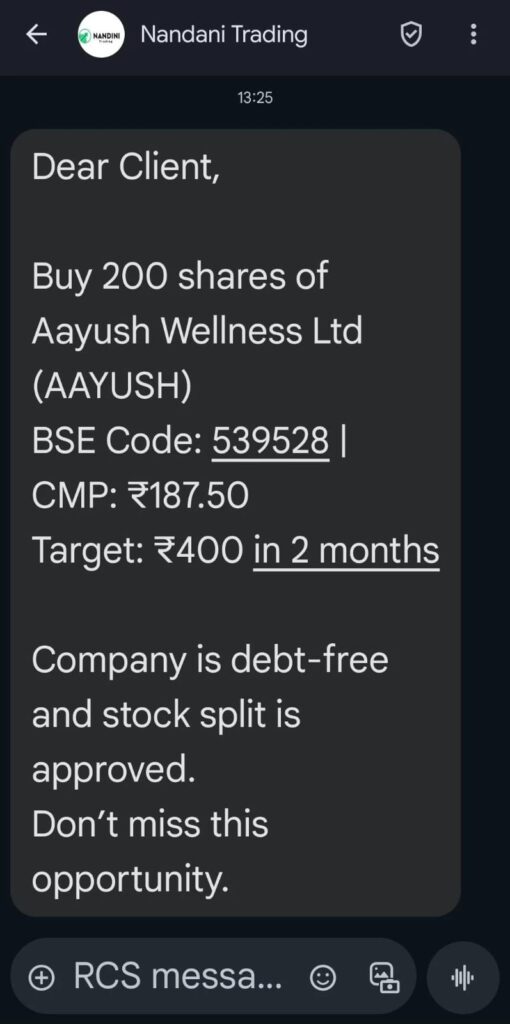

Several investors, including our team, received unsolicited SMS messages like:

“Dear Client, Buy 200 shares of Aayush Wellness Ltd (AAYUSH). CMP: ₹187.5. Target: ₹400 in 2 months. Company is debt-free and stock split is approved. Don’t miss this opportunity.”

This is a textbook scam marketing template. No SEBI-registered analyst. No disclaimers. Just emotionally loaded words designed to exploit FOMO.

Add to that a flurry of coverage in low-tier media houses and aggregators, where articles gloat over the meteoric rise without questioning the fundamentals or risks. The press releases scream “next big healthcare play.” What they don’t scream is that the rally might be completely artificial.

Who’s Buying & Who’s Dumping?

The shareholding pattern is shocking: 100% public float, with zero promoter, FII, or DII stake. That’s a big red flag. Operators thrive in such setups where float is freely available, retail is gullible, and no big watchdog is inside.

This makes the script a sitting duck for operator manipulation, because no large stakeholder is defending or stabilizing the stock.

Why This Is Classic Pump & Dump Behavior?

Aayush Wellness Ltd ticks every box in the classic pump and dump playbook, here’s why:

– It’s a micro-cap stock with a market cap under ₹1,000 crore, making it highly vulnerable to price manipulation.

– The stock has witnessed an explosive 1000%+ rally, much of it driven by locked upper circuits that prevent normal market correction.

– Complete absence of institutional holdings with no promoters, no mutual funds, no foreign investors which is a major red flag

– The company has also been the subject of unsolicited SMS tip blasts, falsely claiming it’s debt-free and promising a stock split.

– The most telling sign is that the stock has been placed under Enhanced Surveillance Measures (ESM) by exchanges – a regulatory step used to monitor stocks exhibiting unusual and potentially manipulative trading activity.

When every signal in the pump & dump playbook is checked, it’s no longer coincidence – it’s a calculated move.

What Happens Next?

– The upper circuits eventually break.

– Those late to the rally get trapped.

– Operators quietly dump their holdings through pre-arranged block deals or small exits.

– Retail gets left holding the bag at ₹150–₹200 per share, while insiders exit at 10x profit.

Then comes the crash. The headlines vanish. The “diagnostics” dream is forgotten.

And retail investors are left wondering what hit them.

Final Word: Don’t Let Hype Rob You

The Aayush Wellness story isn’t about wellness—it’s about retail vulnerability, regulatory lag, and financial manipulation hiding behind herbal buzzwords.

If you’re tempted to enter, ask yourself: Would you buy this at ₹200 if there wasn’t a 900% return behind it?

The answer is probably no.

And that tells you everything.