RBI’s Rate Rollercoaster: How Interest Hikes and Policy Shifts Shape India’s Economic Landscape and Keep Investors on Their Toes

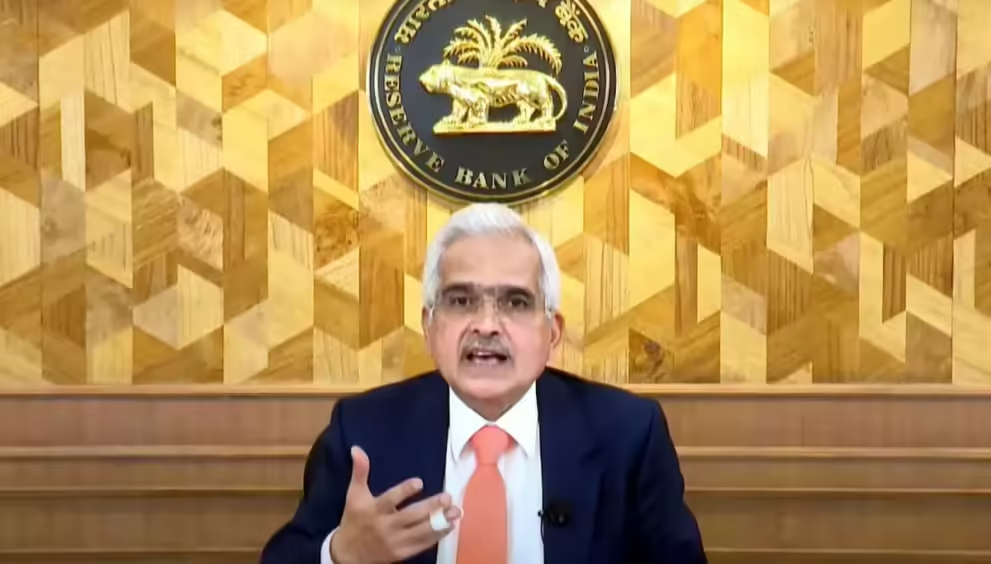

The Reserve Bank of India (RBI) plays a pivotal role in regulating the country’s financial landscape, wielding significant influence over monetary policy. In recent years, the RBI has introduced a series of fiscal measures aimed at curbing inflation, fostering growth, and managing liquidity. These policy shifts have had profound effects on both money and equity markets. This article explores the key policy changes initiated by the RBI and their consequential impacts on the economy.

Read more: RBI Keeps Repo Rate Unchanged. What To Expect In This Emphatic Move?

Key Policy Changes and Their Effects

Interest Rate Adjustments

The RBI’s Monetary Policy Committee (MPC) has employed interest rate adjustments as a primary tool to manage inflation and stimulate economic growth. Between 2020 and 2023, the repo rate underwent significant fluctuations, notably a drop to 4.00% in May 2020 to stimulate the economy during the COVID-19 pandemic, followed by a gradual increase to 6.50% by August 2020. This dynamic approach has allowed the RBI to respond to changing economic conditions effectively.

Liquidity Management

In response to the liquidity challenges posed by the pandemic, the RBI implemented measures such as Long-Term Repo Operations (LTRO) and Targeted Long-Term Repo Operations. These initiatives injected substantial liquidity into the banking sector, enabling credit flow to productive segments of the economy. However, as inflationary pressures mounted, the RBI began to reverse these policies, tightening liquidity to prevent an overheated economy.

Foreign Exchange Management

The RBI has also actively managed the foreign exchange reserves to stabilize the Indian rupee amidst global economic uncertainties. Over the past two years, the RBI’s interventions have led to a decrease in forex reserves, from $642 billion in September 2021 to $575 billion in July 2023. This strategy aimed to protect the rupee’s value but has also contributed to tighter domestic monetary conditions.

Market Reactions and Sectoral Impacts

The fluctuations in the bond market have been closely tied to the RBI’s interest rate changes. As the repo rate increased, government securities yields rose, leading to a decline in bond prices. For instance, the yield on the 10-year government bond surged from 5.82% in January 2021 to 7.25% in August 2023. This upward trend indicates market expectations of further rate hikes and has influenced borrowing costs and profitability in the banking sector. Major banks like HDFC Bank and SBI reported year-on-year increases in net interest income of 19% and 23%, respectively, for Q1 FY24.

On the currency front, the RBI’s interventions in the foreign exchange market, though costly in terms of forex reserves, have been aimed at supporting the Indian rupee. The rupee experienced a notable depreciation of about 8% against the US dollar in 2022, hitting a low of 83.2 INR/USD before stabilizing around 82.5 INR/USD in mid-2023.

The RBI’s policies have had varying impacts across different sectors of the economy. The banking and financial services sectors have benefited from increased net interest margins, with the Nifty Bank index rising by 18% in 2023. Conversely, interest-sensitive sectors like real estate and consumer durables have struggled due to higher borrowing costs. Market sentiment has also been closely tied to RBI signals, with the Nifty 50 index reaching a record high of 20,000 points in July 2023 before experiencing a decline amid growing uncertainty about interest rates and economic growth.

Conclusion

The Reserve Bank of India’s recent policy measures have had far-reaching implications for the bond markets and the broader banking system in India. These policies have led to increased yields on government securities while enhancing net interest margins for banks, albeit at the cost of higher borrowing expenses. Moving forward, market dynamics will continue to be shaped by RBI actions, with a keen focus on inflation and economic growth rates. The interplay between RBI policies and market responses will remain critical for stakeholders navigating the evolving financial landscape.